Obtain a Loan Easily for IT, Manufacturing, Retail, etc

Gowri

Written By

Sector-Wise Business Loan Availability in Chennai

Are you considering establishing or expanding your business in Chennai? Here are a few useful points to keep you ahead of others. Known as the “Detroit of India,” Chennai offers immense opportunities in every domain from IT to retail. Chennai is a brand that offers a lot of opportunities. You have a decent probability of receiving money for your business in Chennai. Now, every fantastic business concept requires funding to become a reality, and that’s where scouting for the best business loan in Chennai comes in. Let’s go into great detail about the business loans available in the amazing city, with respect to every sector!

The Reasons Chennai Is Your Business Haven with a Dynamic Future

Even businesses benefit from the variety of traditions in Chennai. Whether you are in technology, manufacturing, healthcare, retail, or textiles, the city has everything to offer. Additionally, the city is reputed for its banks, NBFCs, and other financial institutions. They compete to provide their customers the best deal, which means the widest product range, the best interest rates, and quick business loan approvals. These refinements are outstanding. The lending ecosystem in Chennai is developing rapidly with AI-powered loan underwriting, digital lending outlets, and novel fintech solutions all competing for users, and funding is more affordable than ever. The government’s initiatives towards digital financial inclusion, in fact, provide even greater security and opportunities with disruptive technology to change the way capital is accessed for businesses, easing the path for startups, and enhancing their prospects of success.

Business Funding in Chennai: Industry-Specific Loan Options and Interest Rates

1)IT Sector: Where Innovation Meets Opportunity

Your Tech Dreams, Funded!

Chennai adores IT companies! For them, tech sectors are a priority, which means sweet deals and offers especially for you. Here’s what awaits:

- Interest rates starting at low percentage

- Loans reaching up to ₹10 crores & more for established companies

- Very light paperwork and no collateral hassles

- Approvals in lightning speed of 5-7 days

Need working capital, new computers, servers, or want to increase your team members? There’s a loan just for that. Better yet, programs like the Technology Development Fund can get more out of your money at reduced rates!

2)Manufacturing Sector: Building the Future

Big Dreams Need Big Funding

Chennai is known for its manufacturing, which includes automobiles, textiles, and even large machinery. Banks are prepared to finance manufacturing enterprises, which is a bonus. This is what you can expect:

- Interest rates between low% (not bad for large sums!)

- Large loans are readily available, with amounts up to ₹10 crores.

- Long and short payback periods of up to customized years, which is quite nice!

- Your machinery and property serve as collateral

The Tamil Nadu government can help you through the Industrial Promotion Policy and related interest subsidies.Small-scale businesses don’t have to worry because they can obtain loans up to ₹2 crores without requiring collateral thanks to CMS Business Finance.

3)Retail Sector: Serving Chennai’s Shoppers

From Corner Shops to Shopping Malls

Retailers love Chennai because it’s a customers’ paradise. There are ups and downs in the retail industry, including busy peak seasons, slower periods, and inventory issues. Banks understand this and offer you their own flexible option.

Retail-friendly features:

- Low interest rates

- Working capital against sales projection

- Specialized inventory financing (because stock is cash!)

- Equipment loans for your new shiny POS terminals

You run an online store? Even better! Digital lending platforms throw away the red carpet for anything e-commerce, with quick approvals and tech-savvy solutions by CMS Business Finance. We offer business loans to those who have a monthly turnover above 20L Per month.

4)Healthcare Sector: Caring for Chennai

Chennai is the health capital of India; if it is related to health care, let it be hospitals, clinics, or diagnostic centres. Lenders will support the cause of his healing.

Healthcare perks:

- Rates as low as low %

- Specialized financing for medical equipment

- Practice acquisition loans for doctors

- Support for the pharmaceutical business

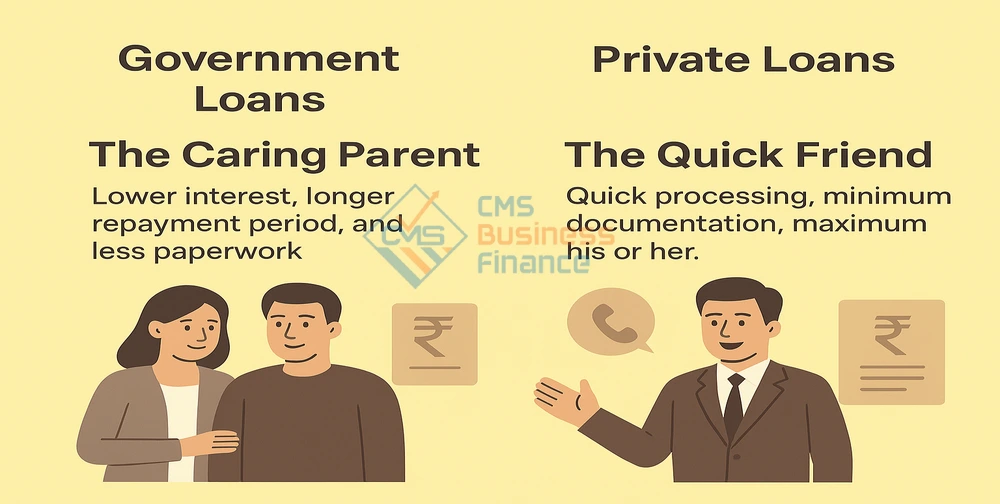

Government vs. Private: Who’s Your Best Friend?

Government Loans: The Caring Parent

Government schemes feel like the supportive parent: lower interest, longer repayment period, and less paperwork. It gives you that extra push in life, like the Pradhan Mantri Mudra Yojana and Stand-Up India programs.

Private Lenders: The Quick Friend

Private business loan in Chennai options are like that friend who can get you out of trouble: quick processing, minimum documentation, and maximum his or her. Usually, a relationship manager is assigned at the very beginning in private banks and NBFCs, and you have a business buddy.

Your Complete Guide to Securing the Perfect Business Loan

Getting the right business loan shouldn’t be overwhelming! Start from the basics: your business has to be in operation for 2-3 years; you need to have clean, audited financial records, positive cash flow, and a good credit score and you should abide by the guidelines. The more specific you are, the more customized these loans will be; in other words, the suits your business wears will fit. So, it will get you better rates with lenders knowing your sector, advisors speaking your language, value-added consulting services, and repayment schedules that match your cash flow. Smart preparation in such a situation would be to compare lenders, organize your paperwork well, and apply simultaneously across institutions. Once you have your loan, ensure you pay on time and continue building trust, update your lender on business growth, utilize the funds for the stated purpose only, and think on how you’ll get more money in the future so you can keep being successful. Different sectors may ask for specific licenses or certifications; your dedicated relationship manager will take care of that so you can concentrate on your business.

Your Business Journey Starts Now!

Chennai has an amazing business-friendly environment where you just cannot go wrong if you decide to open your business. Government schemes provide wonderful terms while private lenders offer speed and flexibility, so the trick is to assess the company’s needs and gain access to the right financial partner who believes in your vision. Don’t let fear of the funding hold you back from fulfilling your dreams, as Chennai’s competitive lending market offers you a choice, better rates and less waiting time. Make that first move and research your options, compare lenders and select financing that resonates with your own business story. Chennai is waiting, there are countless chances, and your ideal funding partner is out there, eager to help you realize your entrepreneurial success story. All it takes is a loan application!