Inventory Financing Support Explanation

Gowri

Written By

How Finance Services in Chennai Support Inventory Financing

Inventory financing is one of the ways to get money where in a way that the businesses will secure the loan with their inventory. Rather than pledging the property or equipment, the businesses will get the loan with the products they are already purchasing or already own. In case you don't pay the loan back, the lender will take and sell your inventory to get their money back.

Usually, lenders will finance between 50% and 80% of your inventory's liquidation value. For example, your stock is valued at ₹10 lakh, and you can expect to get ₹5-8 lakh as funding. The amount will be determined by the speed of selling and the resale price of the products.

The method is easy. You go to a lender and submit an application and business and inventory assets financial details. The lender looks into your stock—analysing product categories, turnover rates, and market demand. Once approved, the funds are made available either in a one-time payment or as a revolving credit line. With this, you use the money to buy new stock, then sell your products and pay back the loan with the interest out of your sales revenue. The most common repayment terms are within 3 to 12 months.

Types of Inventory Financing

-

Inventory Loans: You get a one-off payment upfront based on the value of your stock. This is very suitable for seasonal businesses that are ready for high demand. The loan is paid back by fixed monthly contributions.

-

Inventory Lines of Credit: This facility allows you to borrow an amount not exceeding a predetermined limit, make repayments, and then borrow again as per your requirements. You will be charged interest only on the amount of credit used.

Choosing the Right Financiers in Chennai for Inventory Financing

The business owners in Chennai can also get various financiers in Chennai, who are experts in the area of inventory financing. The options include traditional banks, NBFCs, and alternative online lenders.

Typically, banks provide lower interest rates to their customers but at the same time require an excellent credit history and a lot of documentation to be presented. On the other hand, NBFCs and some other lenders like CMS Business Finance provide a much faster approval process, which might take about 48 to 72 hours with limited documentation process. Those businesses that cannot get bank loans have private money lenders in Chennai as their option, which is a good alternative. These private finance services in Chennai instead of just relying on credit scores, consider the quality of the inventory and the potential of the business.

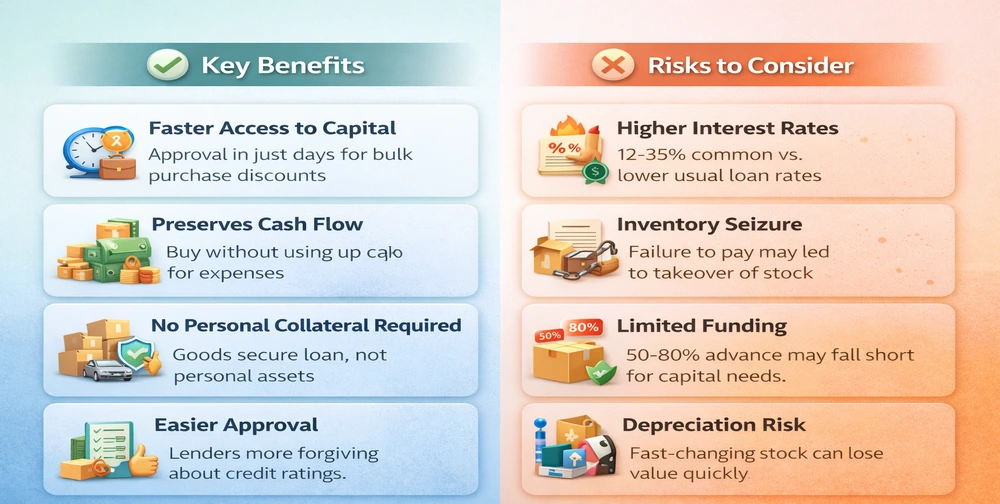

Key Benefits

-

Faster Access to Capital: The approval can take place in just a few days, which allows the businesses to take advantage of the time-sensitive situations like discounts for bulk purchases.

-

Preserves Cash Flow: You can buy without using up the cash necessary for rent, salaries, and other expenditures.

-

No Personal Collateral Required: Your goods are secured against the loan, thus shielding personal possessions such as houses or cars.

-

Easier Approval: It often happens that lenders are more forgiving with regard to credit ratings when it comes to secured business loans.

Risks to Consider

- Higher Interest Rates: The rate will be in the range of 12% to 35% per year, which is much higher than the rate of the usual business loans.

- Inventory Seizure: In case the borrower fails to pay, the lenders have the right to take over the stock, which may lead to the shutting down of the business.

- Limited Funding: The amount advanced to you will not be equal to the full value of the stock. The 50-80% advance may not be enough to meet your actual capital requirements.

- Depreciation Risk: Fashion items, technology gadgets, and seasonal products lose their value very fast, and this might lead to the lenders demanding the repayment to be done much earlier.

Inventory Financing on Who Should Use It vs. Who Should Avoid It

|

Who Should Actually Use It |

Why It Works for Them |

Who Should Avoid It |

Why It’s Risky for Them |

|

Seasonal businesses (e.g., sweets makers during Diwali, clothing stores before wedding season, fireworks sellers during fairs) |

Need large stock in advance without blocking cash flow |

Businesses with low margins (below 15–20%) |

Interest costs can wipe out most or all of the profit |

|

Fast-growing e-commerce sellers |

Orders grow faster than available cash; loans scale with demand |

Companies with slow inventory turnover (6+ months) |

Inventory becomes a liability while interest keeps adding up |

|

Businesses handling large purchase orders (e.g., manufacturers supplying retailers) |

Financing bridges the gap between production costs and customer payment |

Service-based businesses (no physical products) |

They don’t hold inventory — financing doesn’t apply |

Conclusion

Inventory financing is a solution to a major concern of firms that sell products: it provides them with capital to buy new stock without using their operational funds. Moreover, it is a blessing for businesses that work on a seasonal basis, are growing rapidly, and are accepting large orders requiring quick delivery.

On the other hand, the higher costs and seizure of inventory risks make it inappropriate for all businesses. Do the numbers to find out if the extra sales from more stock will cover financing costs. If your profit margins are decent, refreshment of stock is fast, and banks are closed for you, then inventory financing can bring you a lot of growth and development.