Since a loan makes one of the most important financial choices, there are so many considerations, and basically, your future is perched on top of it. For your business, home, or unexpected expenditure, a correct choice regarding who to borrow from will have a serious bearing on the general financial situation of the borrower. Now, in a big metropolis like Chennai in India, there are lending options; however, not all consider what is best for you.

The lending market has gotten quite confusing with different types of lender categories out there, ranging from traditional banks to digital pages. Many signposts might point toward an undesirable lending relationship, so it must be a prudent choice among the options to take. Identifying those early on will save you; if identified late, you will be financially abused instead of enjoying borrowing.

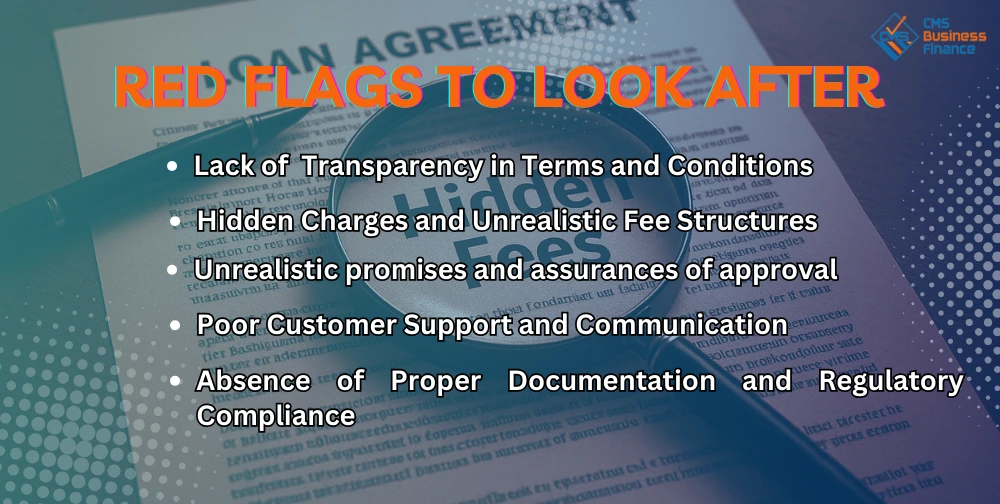

Red Flags to Look After.

Red Flag #1: Lack of Transparency in Terms and Conditions

One of the very significant warnings that could serve as a clue if one is dealing with a loan agency in Chennai is when one is not told about the terms and conditions of the loan. Any lender should always support any claim with the documents containing a clear description of interest rates, repayment schedules, fees, and penalties.

Be especially careful when:

- No document is handed to you before you commit

- The terms are explained with ambiguous words

- You are rushed through the process without full explanation

- They cannot answer direct questions about costs and conditions

Any legitimate lender knows that borrowers must be given time to pursue and understand their commitments. Consider any scheme that pressures you to sign documents without proper time for review as a huge red flag.

Red Flag #2: Hidden Charges and Unrealistic Fee Structures

Unscrupulous financiers lure customers with enticing interest rates and then proceed to rob them with hidden charges. Look closely at the entire fee structure when evaluating any finance company in Chennai.

Beware of:

- Processing fees that appear unreasonably high

- Administrative charges that are vague and without justification

- Penalties for early repayment that were never revealed at the start

- Sudden appearance of new charges in the final paperwork.

A trustworthy lender will explain in detail all existing cost elements so that the borrower is never surprised during the loan tenure.

Red Flag #3: Unrealistic promises and assurances of approval

Lenders who make inflated claims or guarantee of loan approval without carrying out the required due diligence should be extremely cautious. Lending responsibly means verifying your creditworthiness and capacity to repay.

Some red flags include

- Instant approval stand offers with no documentation needed

- Loans that are guaranteed regardless of credit history

- An interest rate they say is so low it cannot be possible

- Pressure to accept an offer within a limited timeframe

Lawful lenders follow regulatory guidelines and apply due diligence. Any private loan in Chennai who offers a loan without following the rightful verification process should send an immediate warning signal. Question the lender’s credibility and if they indeed fall under any category of sanctioned financial activities.

Red Flag #4: Poor Customer Support and Communication

Good customer service will be required throughout the loan process. How a particular lender treats its customers will usually reflect how the company at large treats its customers. Whether or not it truly values client satisfaction.

Indicators of poor customer support include:

- Inability to obtain a representative to address questions or concerns

- Counter staff treating you rudely or dismissively

- No multiple modes for communication enabling you to choose among phone, email, or direct interaction

- Delayed and non-effective responses to queries presented by you and bearing upon your loan

- Absence of unequivocal escalation process mechanism for resolving complaints

A reputable lender will provide its customer support center with adequate manpower and infrastructure. Which greatly values long-term relationships with the client base.

Red Flag #5: Absence of Proper Documentation and Regulatory Compliance

The most important red flag is for lenders who obviously appear to be conducting their business outside the scope of legal and regulatory requirements. This firmly places you in huge legal and financial risk.

Signs include:

- Cannot show proper business registration documents

- No relevant licenses from appropriate regulatory authorities

- No proper evidence of loan agreement or contract

- Business is usually conducted in make shift or unprofessional premises

- No redress mechanism for grievances

Always check that your lender is properly registered with the relevant authorities and follows standard industry practice on documentation and compliance issues.

Conclusion

Choosing the right lending partner goes beyond a swift solution; it’s about peace of mind. The five red flags we discussed can be an early warning system to save you from bad contracts and unscrupulous practices. Examine the documentation, ask questions, and compare a few options. If something seems too good to be true, it most likely is; follow your instincts and look for less dangerous options. Just keep in mind that your financial security is worth that much extra effort. Knowing these signs puts you in a better position to locate a reputable lending partner in Chennai.

For instance, a company like CMS Business Finance is founded on transparency and compliance with regulations. That is the type of standard any loan provider should meet-terms should be clearly stated, should speak honestly, and should be transparent answering your questions. Wise choices do not simply get you a loan; they set up a financial connection that works towards cementing your goals.

Frequently Asked Questions

Q1: How can I verify if a loan agency in Chennai is legitimate?

A: Check if the lender is registered with the Reserve Bank of India (RBI) or other relevant regulatory bodies. Ask for their registration certificate, verify their physical office address, and look up customer reviews online. Legitimate lenders will readily provide their credentials.

Q2: What documents should a reputable lender ask for during the application process?

A: Standard documents include identity proof (Aadhaar, PAN), address proof, income statements (salary slips, ITR), bank statements, and employment verification. Be suspicious of lenders who ask for minimal documentation or request unusual personal information.

Q3: Is it normal for lenders to ask for upfront fees before loan approval?

A: No, legitimate lenders typically deduct processing fees from the loan amount after approval. Be very wary of agencies demanding upfront payments, security deposits, or advance fees before processing your application.

Q4: How much time should I be given to review loan documents?

A: Reputable lenders will give you adequate time (at least 24-48 hours) to review all loan documents. Never sign documents under pressure or without understanding all terms and conditions completely.

Q6: Are personal loans without collateral always risky?

A: Not necessarily. Many legitimate institutions offer unsecured personal loans. However, be cautious of lenders offering large amounts without proper income verification or those with extremely high interest rates.