Choose Before Getting a Loan: Stay Clear About It

Gowri

Written By

Short-Term vs Long-Term Private Loans in Chennai: Pros, Cons & Rankings

It can be really hard to decide if you should take a short-term or long-term loan, and this is even harder when the urgent need for cash arises. If you are a person living in Chennai and you are considering borrowing as your financial aid, you should clearly understand the differences between the two types of loans. This way you will make a more intelligent choice which will be in line with your financial targets.

Understanding the Basics

1.Short-Term Private Loans

The duration of short-term loans is usually from 6 months to 3 years and they are meant for urgent financial needs such as medical emergencies, wedding expenses, or financing of business inventory. The best characteristic of these loans is that they have very high monthly payments but much lower total interest costs.

2.Long-Term Private Loans

On the other hand, long-term loans last from 3 to 10 years and are perfect for major expenses like education, home improvement or the business expansion that you want to do. This type of loan will give you the opportunity to share costs without your monthly budget being too tight.

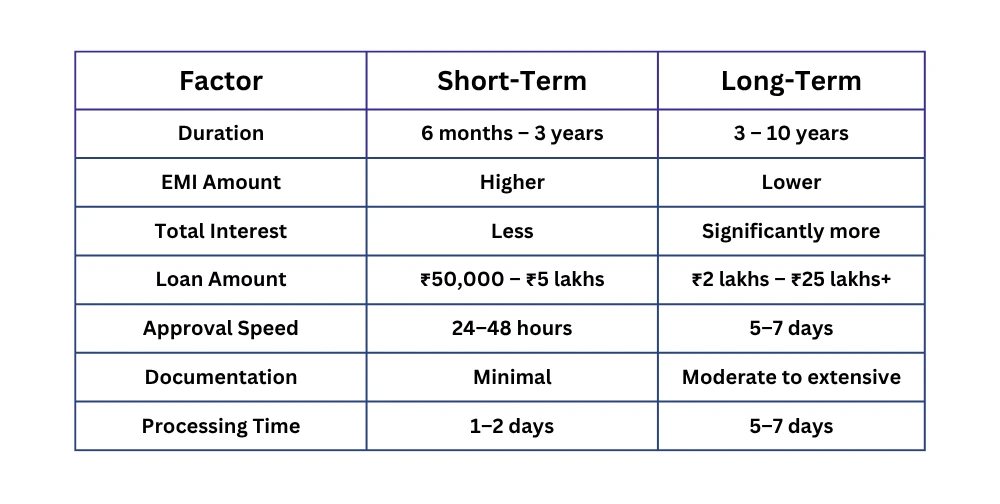

3.Key Differences at a Glance

4.Eligibility & Interest Rates

Both types of loans require the applicant to be 21-65 years old, and to have a credit score of at least 650-700, proof of income for 3-6 months, bank statements, and a valid Aadhaar/PAN card. The interest rate for a private loan in Chennai currently is between 11 and 24% per annum. Non-banking financial companies also charge a very high rate of 16-24% while private banks rate of interest is the lowest at 11-18%. Long-term loans are subjected to a stricter assessment process because of the greater risk involved.

Pros and Cons Breakdown

Short-Term Loans

Advantages:

-

Pay 40-60% less total interest

-

Quick debt clearance within 1-3 years

-

Rapid 24–48-hour approval

-

Minimal documentation required

-

Faster credit score improvement

-

Perfect for emergencies

Drawbacks:

-

Higher monthly EMI burden (2-3x more)

-

Requires strong consistent income

-

Limited borrowing (usually ₹5 lakhs max)

-

Less repayment flexibility

Long-Term Loans

Advantages:

-

Lower monthly payments (50-70% less)

-

Access to larger amounts (₹2-25 lakhs+)

-

Better cash flow management

-

Ideal for fixed-income earners

-

Less monthly financial stress

Drawbacks:

-

Pay 80-150% more in total interest

-

3–10-year debt commitment

-

Vulnerable to interest rate changes

-

Extensive documentation needed

-

Longer 5–7-day approval time

Best Use Cases in Chennai

Choose Short-Term When:

-

Mental crises at Apollo, MIOT, or Fortis

-

Business working capital in T. Nagar or Parrys

-

Marriage or festival costs

-

Monthly income more than ₹50,000 with extra

Choose Long-Term When:

-

Tuition for higher education

-

Cosmetic in Anna Nagar or Velachery

-

Business allotment or equipment purchase

-

Debt restructuring

-

Monthly income ₹30,000-50,000 but stable

Top Private Loan Rankings in Chennai

According to interest rates, speedy approval, flexibility, and customer satisfaction, the private finance in Chennai options rank as follows:

Tier 1: Premium Performance

-

Interest Rates: 11-15% per annum

-

Approval Time: 24-48 hours

-

Flexibility: High (no prepayment penalties, top-up facility)

-

Best For: Salaried professionals with credit scores above 750

Tier 2: Balanced Options

-

Interest Rates: 15-18% per annum

-

Approval Time: 2-4 days

-

Flexibility: Moderate (partial prepayment allowed)

-

Best For: Self-employed individuals, small business owners

-

Example: Lenders like CMS Business Finance offer competitive rates with personalized service for entrepreneurs and self-employed professionals

Tier 3: Accessible Lending

-

Interest Rates: 18-24% per annum

-

Approval Time: 3-7 days

-

Flexibility: Limited (prepayment penalties apply)

-

Best For: First-time borrowers, average credit scores (650-700)

The financial market in Chennai is not so spread out and is mostly concentrated in T Nagar and Anna Nagar. Because of this, a lot of competition has been created that has led to better rates and faster processing. Additionally, the tech-enabled lending platforms are offering a completely digital experience while still being backed by a trusted finance company in Chennai.

Smart Tips for Choosing the Right Loan

1.Calculate Total Cost: A loan of ₹5 lakhs at 18% for 5 years will cost the government 2.71 lakhs in interest while just 97,000 for 2 years. Use EMI calculators to compare

2. Assess Your Cash Flow: Always reserve 20% for crisis situations. If the EMI is more than 40% of your income, go for the long term despite the higher total cost.

3. Improve Your Credit Score: The rise of a score from 680 to 740 can mean 2-4% interest reduction, resulting in a few thousand saved.

4. Watch for Hidden Costs: Application fees (1-3%), prepayment penalties (2-5%), late payment fees (₹500-1000), and cheque bounce charges can together increase your payment by ₹10,000-50,000.

5. Compare Multiple Lenders: Chennai's active lender market exceeds 50. Be sure to examine at least 5 possibilities before making a decision.

6. Check Prepayment Flexibility: It is wise to pick lenders who provide no-penalty or low-penalty prepayment to allow for financial flexibility.

7. Keep Documentation Ready: For a speedy approval, prepare 6 months' bank statements, 3 months' salary slips (or 2 years' ITR), Aadhaar, PAN, and employment proof.

The Bottom Line

There isn’t a straight line between short-term and long-term loans as one is better than the other—the appropriate option is dictated by your financial situation. To put it another way, short-term loans will be feasible for the buyers with an EMI handling capacity above ₹20,000-30,000+ for whom interest savings are the priority issue.

To the contrary, long-term loans will be easily applicable to those having large amounts with comfortable monthly payments of ₹8,000-15,000. The competitive lending landscape in Chennai offers very tangible benefits but entails a higher responsibility of making the right choice. Calculate all the possible scenarios, know every fee, and make sure the loan is in line with your financial goals without causing you the stress. Being a smart borrower today will lead to a strong debt-free future.

Frequently Asked Questions

1. Can I combine short-term and long-term loans for multiple purposes?

Yes. For example, you could take a short-term loan for emergency medical needs at MIOT or Apollo, and a long-term loan for business expansion in Perungudi or OMR.

2. How quickly can I get a private loan if I have an urgent medical emergency in Chennai?

Short-term loans can be approved in 24-48 hours, making them ideal for hospitalizations at Fortis, MIOT, or Apollo hospitals.

3. Do long-term loans offer benefits for home renovations or cosmetic upgrades?

Yes. Long-term loans with 3–10 year repayment terms help manage monthly EMIs while funding renovations or cosmetic procedures in areas like Anna Nagar or Velachery.