Get Ideas To Develop Your Business With Experts

Gowri

Written By

Top 7 Benefits of Taking a Private Business Loan in Chennai for SMEs & Startups

Setting up a small enterprise or starting a business in Chennai, no doubt, faces a number of obstacles—the most significant one being the getting of funds when most needed. Traditional banks most of the time have a slow and lengthy approval process, strict qualifying requirements, and a lot of forms to fill in. Alternative financing options can help in this situation. Let's find out the reason why these flexible funding methods are gaining more and more popularity among the entrepreneurs as the main source for their growth.

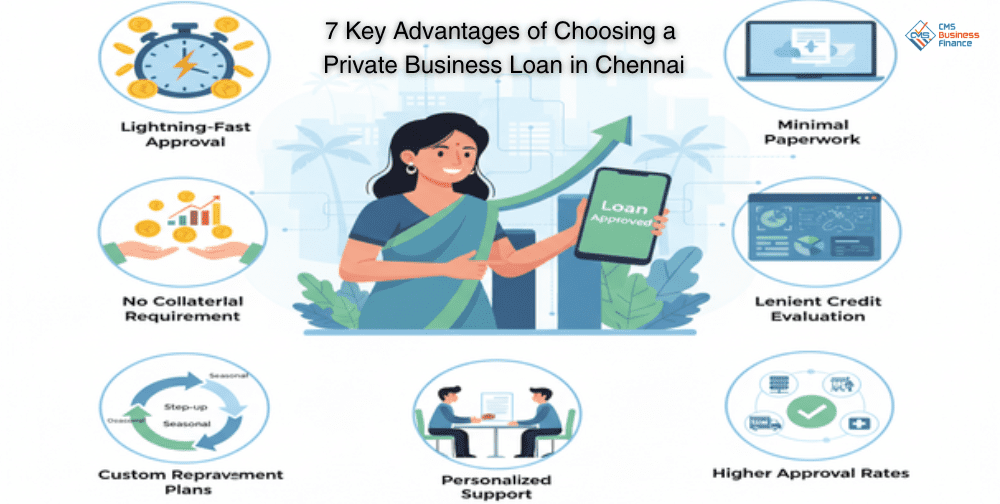

7 Key Advantages of Choosing a Private Business Loan in Chennai

1. Lightning-Fast Approval and Disbursement

Money is measured in time, particularly when one is attempting to grab a market opportunity or dealing with necessary overheads. Private business loan in Chennai suppliers usually approve applications within 3 to 7 working days whereas conventional banks may take somewhere around 30 to 60 days for loan approval. Digital lending has been a major game changer during this cycle in 2024–2025 by applying AI-driven credit checks that assess the potential of your business besides just looking at the historical financials. For instance, a food delivery business in Chennai that is planning to add to its fleet during the festive season rush might be able to grab a part of the market due to the quickness of financing and not be left out. Choose CMS Business Finance for your immediate funds for your business development. Those who have a monthly turnover of 15 Lakhs and above can easily complete the loan process without collateral.

2. Minimal Documentation Hassles

Do you still remember those times when you had to submit so much paperwork and go to the bank several times? These are getting rarer and rarer. Current alternative lenders have considerably eased their documentation requirements. The majority now ask only for basic proofs of business registration, bank statements for the past 6 months, and GST returns. A few fintech platforms even link up directly with your accounting software and retrieve the financial data by themselves. This lessening of the paperwork burden means that you will not only spend less time on loan applications but also more time on your business that is growing.

3. Flexible Collateral Requirements

Lack of large security assets is one of the main obstacles for startups and young SMEs. Collateral-free loans or offering alternative security options are the private finance in Chennai methods often used for lending purposes. Instead of demanding property or other high-value assets, the lenders could take into consideration business receivables, inventories, and even future revenue projections. A SaaS startup in the IT corridor of Chennai, for instance, could be easily financed based on their recurring revenue model even if they have no physical assets at all.

4. Lenient Credit History Evaluation

Just starting your venture? Not having a good credit history should not be the factor that stops you. While traditional banks put heavy reliance on your credit score and time in business, online lenders go for a little different, more holistic approach. They not only consider your business model, market potential, cash flow but also examine your company's social media presence in order to conclude your creditworthiness. This can be very advantageous for those novice entrepreneurs who haven't had the opportunity to establish a big credit portfolio yet. Provided that you show a feasible business strategy and the ability to always generate revenue, the chances of getting approved are quite good.

5. Customized Repayment Structures

Cash flow cycles differ from one business to another. A wedding season might cause a textile manufacturer in Chennai to have a seasonal peak, however, a B2B software company might take a quarterly payment cycle route. Private loan in Chennai providers are well aware of such variations in cash flow and thus provide custom made repayment schedules. Repayment options offered include bullet payments, increasing-emis (step-up EMIs) that go up as your revenue goes up, or seasonal repayment plans which are synchronized with your business cycles. Thus, the flexibility facilitates easier management of working capital as it does not require any strain on your operational budget.

6. Higher Approval Rates for Diverse Business Types

Long-established banking institutions normally give precedence to the companies that have already established their presence in the conventional sectors. However, Chennai's business landscape is very much mixed—from kitchen cloud and making content to factories and tech-startups in healthcare. Non-conventional financing is gradually gaining credibility for the futuristic and increasingly nontraditional business models that they assess on the basis of your market opportunity, competitive advantage, and founder capabilities instead of just the pre-defined boxes. This very inclusive strategy is facilitating the entry of the most innovative business ideas that would be cash-strapped otherwise.

7. Personalized Service and Ongoing Support

Moreover, alternative lenders are not simply the ones to disburse funds but also consider themselves as the partners in growth. Usually, the client is assigned a particular relationship manager who is aware of the business context and local market dynamics. Is it difficult for you to pay back the loan during that quarter? Do you want to increase your borrowing limit as your business grows? Such conversations are going to be very amicable with the lenders who are focusing on relationship development rather than on the business transactions. Certain platforms even go to the extent of providing complementary services, such as offering financial planning tools, facilitating business networking connections, and giving access to mentors in Chennai's entrepreneurial ecosystem.

The Path Forward for Your Business

Capital shouldn't be the issue that prevents your company from unlocking its complete potential. Alternative financing methods are coming up as the city's innovation and entrepreneurship scene increasingly attracts attention and power. More and more, the money provider companies, for instance, CMS Business Finance, are coming to the aid of the local startups and SMEs with their specially made solutions for them. The secret is to get a lender who is knowledgeable about your sector, will work according to your pace, and who has clear and fair charges with no surprises.

Before settling for one option, look at the interest rates, processing fees and prepayment options of multiple lenders. A good idea would be to take customer reviews into consideration, to check if the company conforms to the regulations and most important, to make sure that you are comfortable with the total cost of the loan. If the funds are used at the right time and in a proper way, then they can increase your business growth significantly.

Are you ready to grow your business with funding?

Look at the financing options that support your business goals, analyze terms with utmost care, and take that decisive step towards expanding your enterprise with confidence. Your journey as an entrepreneur is worth a financial partner who not only shares your dream but also supports you on this challenging road.