Funding Challenges Faced by Retail Businesses

Gowri

Written By

Retail Funding Challenges: Business Loan Providers in Chennai

In the highly competitive market of Chennai, Tamil Nadu a retail business does not really depend only on quality products but also on smart financial planning and availability of the right funds. A small boutique in T. Nagar or a big grocery chain in Tiruppur or different parts of the area, the business sustainability and growth are directly linked to proper understanding of the funding sources.

Retail business has to deal with unique financial pressures such as needing working capital that grows with the season, inventory that takes up a lot of cash, expansion that drains lots of investment, and technology upgrades that require capital. About 60% of retailers are facing cash flow management as their main operational challenge and accessibility to funding is mentioned nearly as often.

The guide is grounded on the experience of the business loan providers in Chennai and it aims at helping retail entrepreneurs in overcoming the difficulty of finding funds.

Understanding Funding Obstacles: From Working Capital to Machine Loan in Chennai

Retail, especially in Chennai, has various funding hurdles to overcome. The first and foremost problem to be mentioned is cash flow timing mismatch. The retailers are required to pay suppliers in advance for the inventory and, on the other hand, they get customer payments only after sales thus creating gaps that can stretch from 30 to 90 days.

Banks have it that retail loans are a bit riskier than other loans. The approval rates for retail business loans from traditional banks stay around 40-45%, while the processing time is 3-4 weeks. The interest rates are usually set at 11% to 18% per annum depending on creditworthiness and collateral.

In addition, equipment financing presents a specific challenge in this aspect. Retailers requiring refrigeration units, billing systems, or display fixtures normally discover that general business loans do not fully support their needs. This is why specialized products such as the one called "machine loan in Chennai" become extremely useful. These kinds of particular financing solutions provide retailers with the ability to get the necessary equipment, using the same equipment as collateral, thus making the approval process easier and the repayment period more flexible—usually 12 to 60 months at interest rates of 10% to 16%.

Private Finance Services in Chennai Offering Alternative Options for Your Business

Chennai's financial ecosystem has gone beyond traditional banking, and new alternative lending options have come up. Retailers in Chennai needing quicker acceptance or more adaptable terms have turned to private finance in Chennai as one of the solutions that established services which have already stimulated as the most feasible alternative choices.

Private non-banking financial companies (NBFCs) and fintech lenders have a lot of benefits to offer. They usually give the decision on a loan application within 24-48 hours, as opposed to weeks that banks take. The documentation is also less, with several lenders accepting even digital bank statements and GST returns. The loan amount for working capital can be set as low as ₹50,000 and as high as ₹50 lakhs for expansion. Nevertheless, the interest rates charged by private lenders are typically between 14% and 24% per year, which is quite high. Also, the processing fee is usually 2-4% of the loan amount, making it costly.

Invoice discounting, supply chain financing, and peer-to-peer lending platforms are some of the other ways to access alternative funding. Renowned providers such as CMS Business Finance are there to offer the retail sector of Chennai the most advanced and mobile finance solutions adapted to their needs and with flexible terms.

Though banks provide their clients with lower interest rates, their harsh requirements leave out about 55% of small retail applicants. On the other hand, private lenders approve 65-70% of applications but at a higher cost.

Real Insights from Lenders

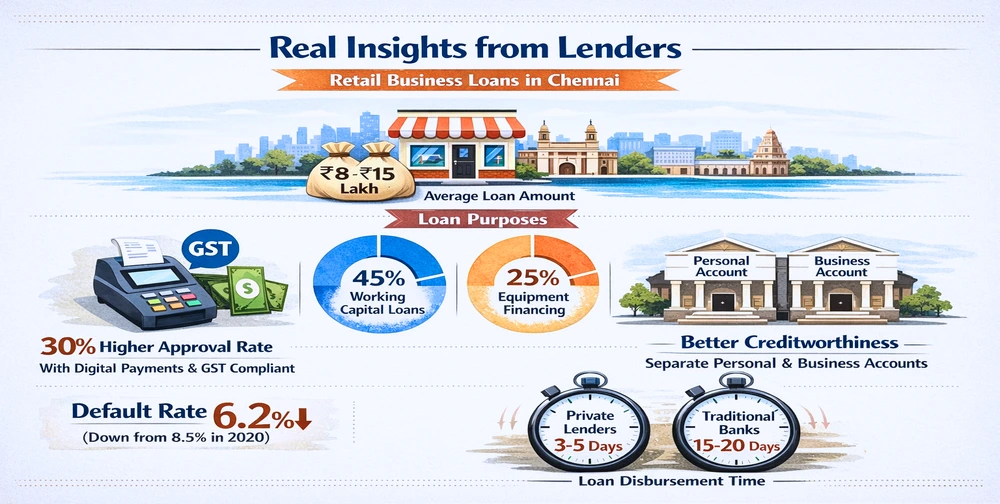

Tamil Nadu's leading NBFCs' data reveal that the average retail business loan in Chennai is between ₹8 lakhs and ₹15 lakhs. Among the segments of retail lending, 45% consist of working capital loans, 25% are used for equipment financing, and 20% are for expansion loans.

According to lenders, the 30% approval rate is more for the retailers who have digital payment infrastructure and are compliant with GST. There is a concept of better creditworthiness among the businesses that keep personal and business bank accounts separately as it manifests good financial discipline.

The retail lending default rates are reported to be around 6.2% at present from a high of 8.5% in the year 2020. The turnaround time for retail loans disbursed to clients of private lenders in Chennai is around 3-5 business days whereas it is 15-20 days for traditional banks.

Actionable Tips for Retailers Seeking Funding

To facilitate their access to funds, retail businesspersons should take these practical steps:

-

Keep comprehensive financial records for at least 12 months comprising bank statements, GST returns, profit and loss statements, and balance sheets. The quality of documentation is a major factor that determines approval.

-

Create your business credit score through credit bureaus like CIBIL and Experian. Having a score of over 750 gives a considerable advantage in terms of approving the loan and reducing the interest rate by as much as 2-4 percentage points.

-

Select the loan product that best fits your particular need; do not apply for a general business loan when more specialized products like equipment financing are more appropriate for your requirement.

-

Draw up a utilization plan that is very clear and indicates how the funds will be able to produce returns. The lenders want to be convinced that an investment of ₹10 lakhs in inventory will bring in a sale of ₹15 lakhs within a certain period.

-

Don't go for major expansion financing all at once; instead, start with smaller loans and gradually build your repayment track record.

Conclusion

Retail funding difficulties in Chennai, Tamil Nadu are to be navigated only through understanding traditional and alternative sources of finance. The banks may give lower cost but the private lenders give the accessibility and the speed. The match between the business needs and the financing sources is the way of the key, along with the financial discipline, and setting up the good rapport with the lenders who are trustworthy.

In case you want to have working capital for buying inventory that changes by season, equipment financing for improving your store, or capital for a new site, Chennai's comprehensive financial ecosystem has got your back. Retail business owners can not only avail of the funding but also make it their strength by making the right moves and having the right partners in this competitive market.